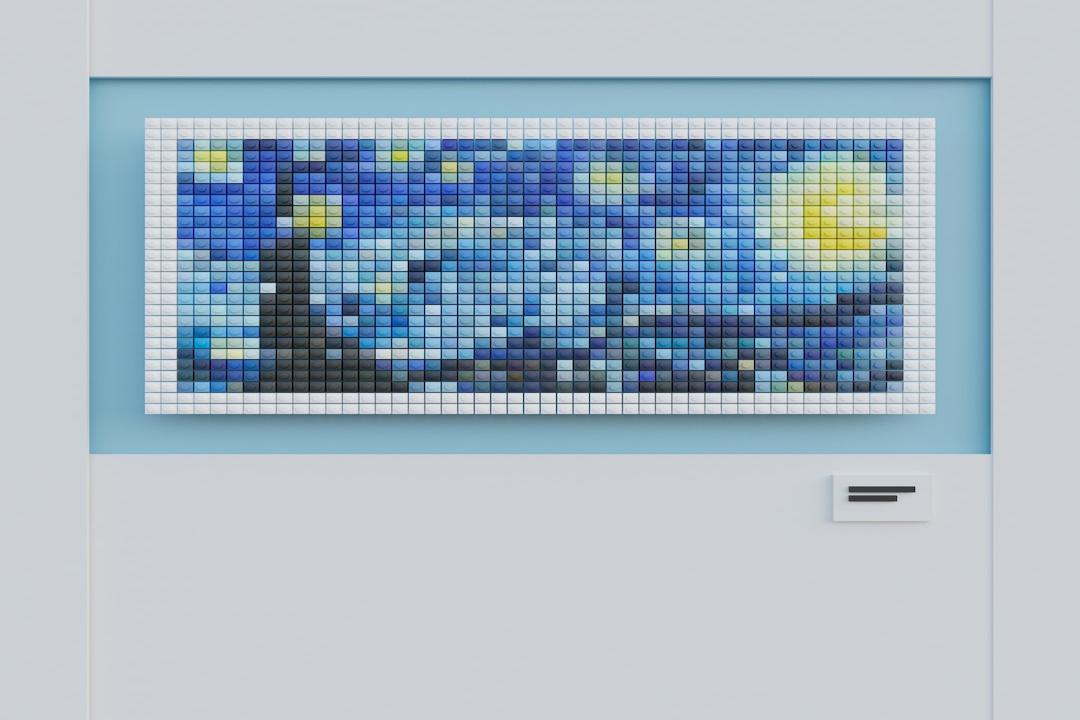

The market has seen a significant increase in stablecoin inflows, indicating a rise in liquidity entering the market. This shift in supply and demand fundamentals for Bitcoin could lead to more price fluctuations, as highlighted by CryptoQuant. The chart below visually demonstrates the correlation between Bitcoin’s price movements (represented by the white line) and stablecoin inflows (represented by the blue region).

Source: CryptoQuant

Bitcoin’s price has been experiencing volatile swings, coinciding with the occurrence of stablecoin inflows. It is worth noting that these sharp price movements are closely tied to sudden spikes in stablecoin inflows.

The surge in stablecoin inflows, as depicted in the chart, signifies a significant increase in liquidity entering the market. Such liquidity surges have a notable impact on Bitcoin’s supply and demand curve, potentially leading to price volatility.

Traders and investors must exercise caution and take advantage of the increased volatility as liquidity floods the market. This surge in liquidity has stimulated more trading activities, resulting in potentially faster movements in Bitcoin and other cryptocurrency prices.

Furthermore, the influx of stablecoins could generate positive market sentiment as investors view it as a growing interest in digital assets. This, in turn, influences the investment behavior of market participants and contributes to the price movements within the cryptocurrency market.

The increased liquidity also creates a more flexible and speculative trading environment. However, it is important to note that greater liquidity can also introduce market instability. Sudden price fluctuations may catch investors off guard, resulting in short-term profits or losses.

Overall, the noticeable surge in stablecoin inflows is a positive indicator of market activity and dynamics. As these stable assets continue to flow into the market, they bring heightened liquidity, potentially fueling increased trading volumes and market participation. However, it is crucial for investors and traders to remain vigilant and well-informed. The abundance of liquidity injected into the market can have significant implications, not only for Bitcoin but also for the broader cryptocurrency market ecosystem.

Tags:

BTC