According to a recent report by Glassnode, a prominent market intelligence platform, it has been revealed that Coinbase reigns supreme in the cryptocurrency market. This platform holds a substantial amount of Bitcoin and operates through two main segments, Coinbase Exchange and Coinbase Custody.

The report indicates that Coinbase and Coinbase Custody collectively possess around 270,000 BTC and 569,000 BTC, respectively. This significant investment showcases Coinbase’s key role in the cryptocurrency ecosystem as both a trading and storage platform.

As major exchanges like Coinbase take center stage in the evolving cryptocurrency landscape, their massive coin holdings give them a strong influence over market liquidity and regulatory perspectives. Coinbase stands out as the largest custodian by a considerable margin, serving as both an exchange and a provider of private spot ETFs, underscoring its importance as infrastructure in addition to being a market player.

While Coinbase solidifies its position as a dominant player, the broader market dynamics paint a complex picture. Despite being the second-largest spot cryptocurrency exchange after Binance, Coinbase exhibits unique trends in market activity. Over the past 24 hours, Coinbase saw a trading volume of approximately $1.45 billion.

Coinbase holds a significant portion of aggregate exchange balances and US Spot ETF balances through its custody service. The entities of Coinbase Exchange and Coinbase Custody currently possess an estimated 270k and 569k BTC, respectively.

On the other hand, when it comes to website visits, there is a noticeable disparity between Coinbase and its top competitor, Binance. Coinbase attracted around 66,913 weekly visits, significantly fewer than Binance’s 14 million, indicating varying levels of user engagement across platforms.

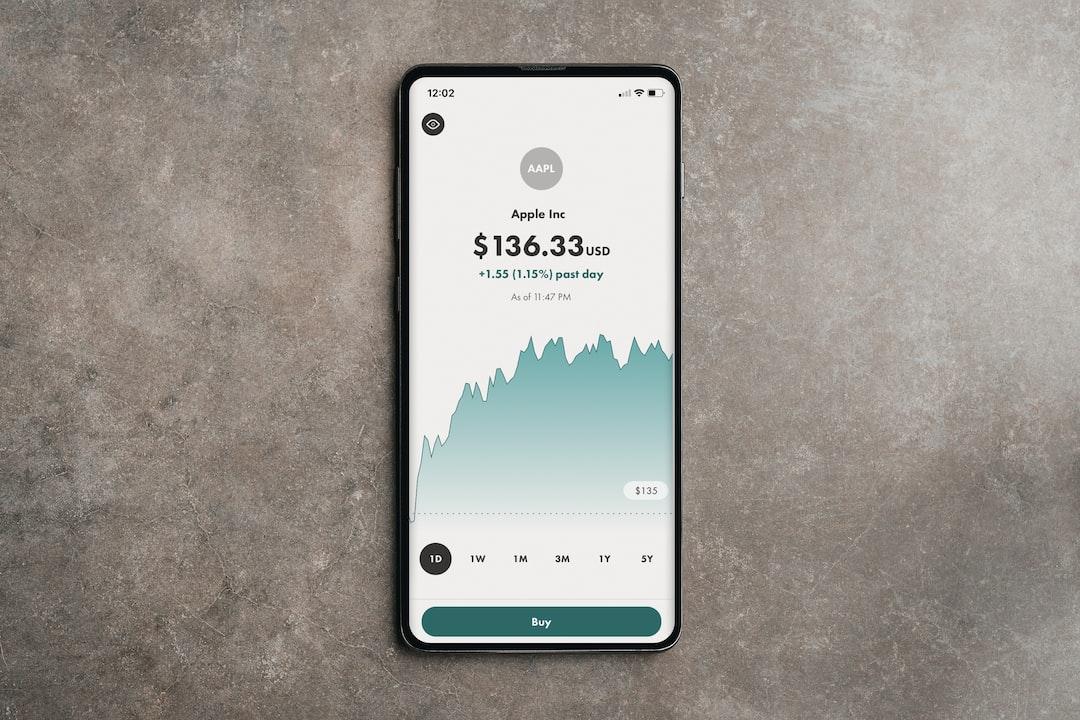

Despite these market dynamics, Bitcoin’s performance continues to face challenges. The leading cryptocurrency has seen a decline of 2.7% in the past day and 5.5% over the past week, leading to a current trading price of approximately $65,228. This downward trend in Bitcoin’s price adds further complexity to the market outlook, impacting investor sentiment and market stability.